Financial Assistant

Financial Assistant Chatbot based on Oracle’s RCS, and Open Banking

UX/UI

Chatbot

Finance

Introduction

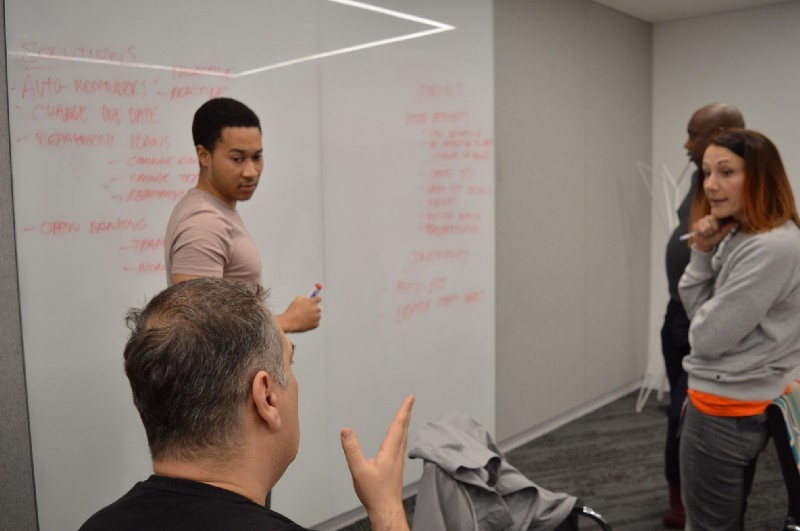

Oracle, Orange and Mobile UX London have held a 2 day Hackathon at the Oracle London office. The focus of this event was to showcase Rich Communication Services and how we can give people a better understanding of what’s in store for the future.

At the end of this event, my team of five created a chatbot prototype that helps people control their financial situations, have savings, and help with payments.

Our prototype is based on Rich Communication Services (RCS), Chatbots and Open Banking functionalities. Rich Communication Services (RCS) is a communication protocol between mobile-telephone carriers and between phone and carrier, aiming at replacing SMS messages with a text-message system that is richer, provides phonebook polling (for service discovery), and transmits in-call multimedia.

Messaging is also great for companies to connect with engaged clients with their apps. It provides an opportunity to start an instant conversion, like making offers and promotions, sharing the shipping status of an order, and the upcoming bill payment. Marketers also have a chance to enrich their campaigns by using a mobile app that uses a Rich Push message when a user opens the notification. Push notifications with a Rich Push message are helpful.

Chatbots – “conversational agents” – are software applications that mimic written speeches to simulate a conversation or customer interaction. Chatbots are used most commonly in customer services. Conversational agents are becoming much more common partly because creating chatbots is easy. Today, you can make your chatbot based on Facebook Messenger.

Here some chat bot tools you can find in the market:

From our experiences and research findings in the financial sector. There are some pain points that financial companies and their customers suffer from. Customers suffer from paying banking fees. Entering into the collections process is an unwanted situation for both parties. The lack of direct and instant communication between customers and lending companies to prevent missing repayments is another financial problem. It also creates a service to help people who are in financial difficulty.

Lending companies like banks have to collect their unpaid debts from clients. These unpaid debts can be loans, credit cards, unpaid bills, or missed mortgage payments. If the customer misses one or two payments, they will enter collections. This is a costly process for a bank, and it takes effort and time to recover these payments. Also, for the customer side, it isn’t suitable for the customer to use credit score or have additional costs.

Design Process

There are different approaches and ways of following a creative process. We would like to follow a well-known model, which was defined by the Design Council as the Double Diamond. This model includes a discovery phase that gives us a chance to create an insight into the problem and a definition phase that will be a foundation for the further creative process. The third phase is the development phase for building a prototype. The last phase is the delivery stage for the final version of our product.

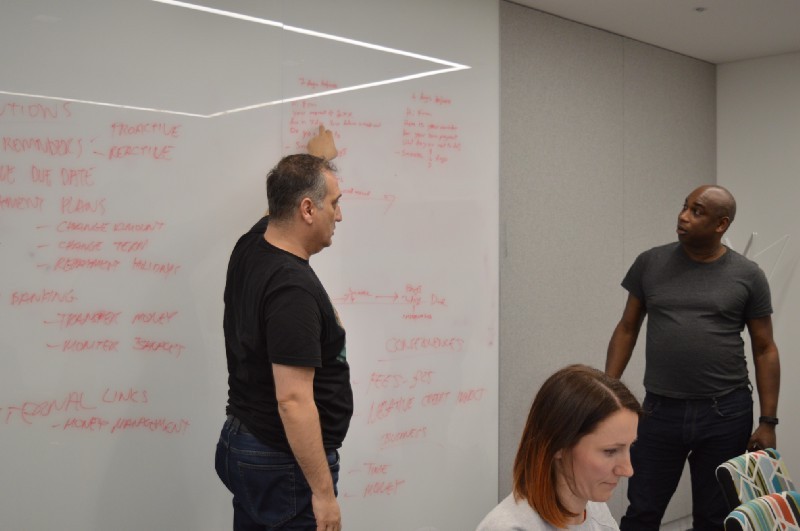

We focused on the current collections processes, personas, possible solutions, user scripts and the prototype. We didn’t follow the exact user centre design given time and resources.

We started our research by understanding the collections process banks and agencies follow today. This prepared us to understand lenders' challenges when lending money or being owed money.

The collections process can be defined as the following:

The customer misses a payment

The lender sends warning letters

The customer is charged a fee

The lender continues to try to contact the customer with letters and calls.

The aim of this is to:

Understand why customers missed their payments.

Try to collect outstanding payments.

Understand if this is a short-term issue or something more serious.

Avoid writing off outstanding balances for individuals without the intention of paying them back.

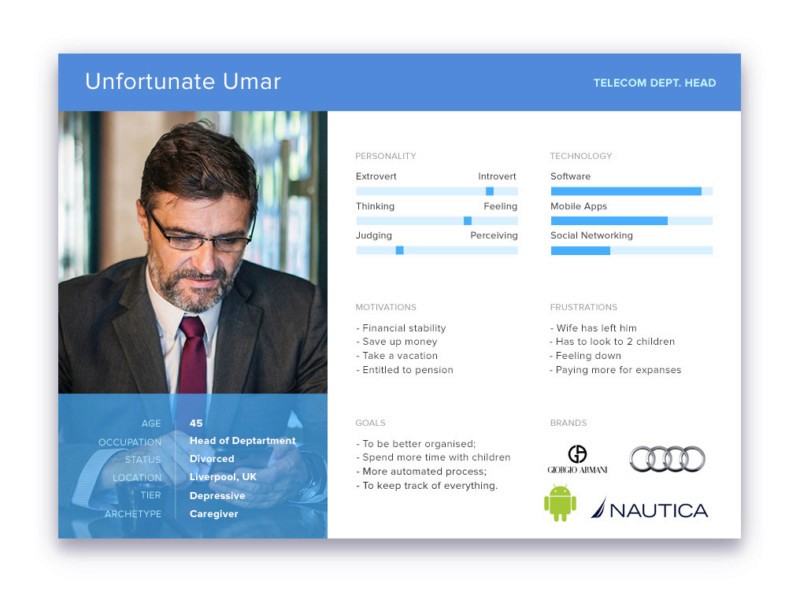

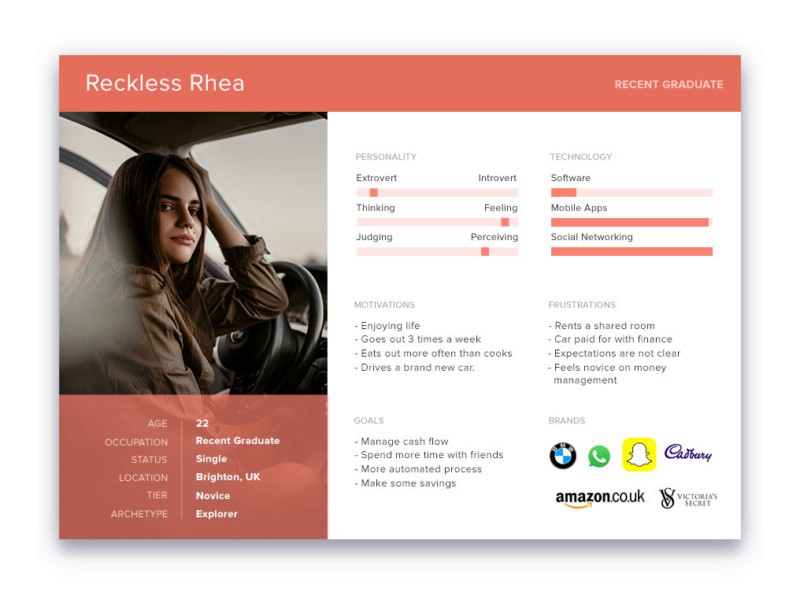

Personas

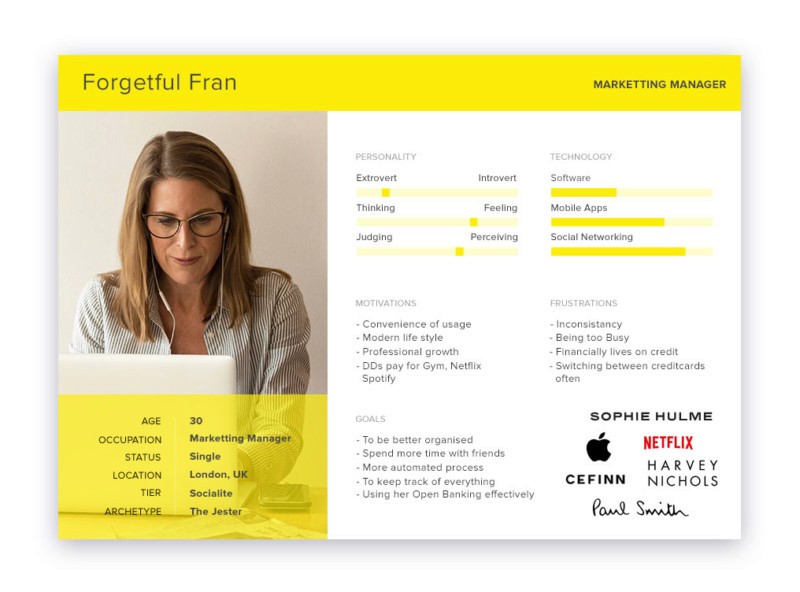

To better understand who we would be trying to solve for, we created 3 personas which fall into the category of people who fall into collections; this was based on research and previous knowledge on the subject:

Ideation

Once we had established the personas, we moved on to brainstorming different solutions that could solve these problems using a chatbot.

Once we had an idea of the different solutions, we started to map out the user journey and user scripts for our chatbot prototype, abolished the personas, and brainstorm different solutions that could solve these problems while using a chatbot.

Our Solution

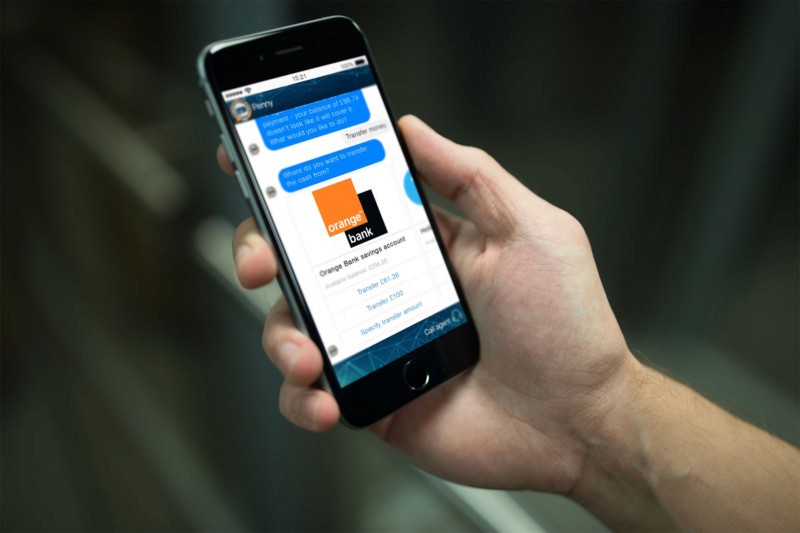

Introducing Penny the Financial Assistant

How will it work?

Uses Open Banking

Continually assesses user’s income and expenditure.

Warns the user if their balances won’t cover upcoming outgoing payments

Offers quick solutions to avoid fees, e.g. transfer money from another account or pay now with a bank card

Provides options to make arrangements if a customer is having financial difficulties, such as changing direct debit dates, taking repayment holidays or interest freezing if Penny deems it necessary

Assesses financial problems, changes of circumstances or any other issues which will trigger Penny to provide support, e.g. point users towards free organisations that can give advice, such as the citizens' advice bureau.

Personality

When building a chatbot, it is very important to create its personality or persona—this directs the type of language and emotion communicated to the user.

Penny will have the following attributes:

Empathetic: people know they won’t get an ear bashing when things go wrong.

Positive: a can-do attitude, focused on solutions.

Realistic: doesn’t get the customer’s hopes up.

Friendly: even when delivering bad news

Fun: especially when reporting on the day-to-day

Penny will adopt different tones of voice depending on where the customer is in the collection process.

Example:

The tone can be more light-hearted if the customer hasn’t missed a payment yet.

If the customer has missed any payments and is in real financial difficulty, we will remain empathetic but direct while highlighting any consequences, if necessary.

What are the benefits?

For the user

Doesn’t need to log into online banking

Face-less; no human judgement

No lengthy income and expenditure forms

Fairer

Avoid bank charges for accidents.

For the lender

Cost-efficient; less time and money spent chasing the customer.

Corporate Social Responsibility – refer people to organisations that can help

Fewer people enter the collection process

Minimise bad debt

Scenario

Given that our time was finite, we focused only on the one persona – Forgetful Fran.

In Fran’s case, she has no financial difficulties but is just forgetful regarding her finances and payments.

She needs:

It is an easy way to remember what money is going out when

To know before it happens when she is going to miss a payment.

Reminders so she can keep on track

In this scenario, we broke down the sequence of events as follows:

Fran’s bank balance is low and won’t cover her next outgoing direct debit payment.

Penny alerts Fran of this and offers options: Transfer Money from another account, pay with a credit/debit card or remind me later.

Fran asks Penny to remind her later.

On schedule, Penny reminds Fran of the low balance and upcoming direct debit.

Fran quickly transfers money from another account using open banking, covering her next outgoing payment.

Penny transfers funds and confirms that the direct debit payment was successful, avoiding paying any bank fees.

Prototype

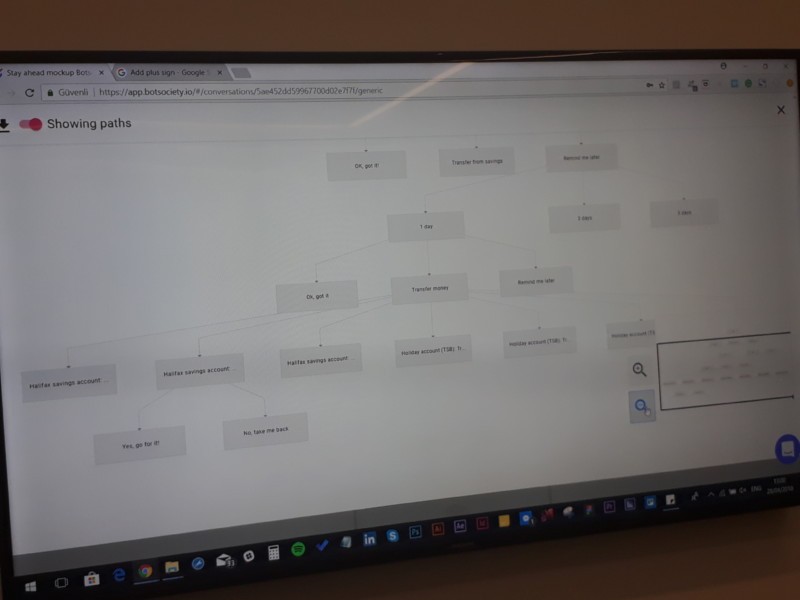

Now that we have finalised the scenario for Fran, we started drafting the script for the prototype.

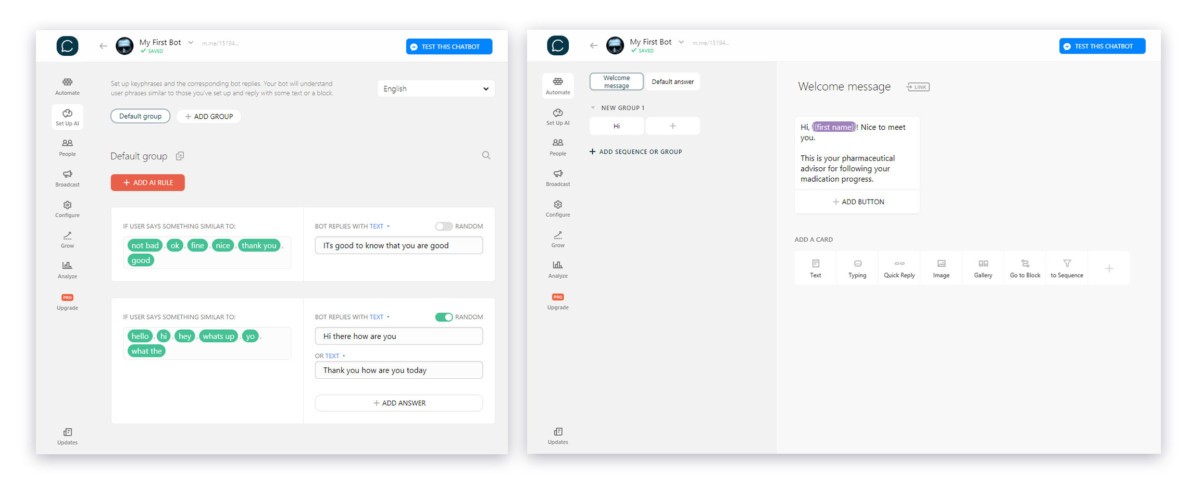

The team used a free prototyping tool called Botsociety to build chatbots. In our first draft, we added all the conversation scripts discussed; however, after internal review— we agreed the conversation needed sprucing up.

From there, we used emojis and gifs and changed the conversation colour scheme (where appropriate). Here is our final prototype for a conversation with Fran and Penny.

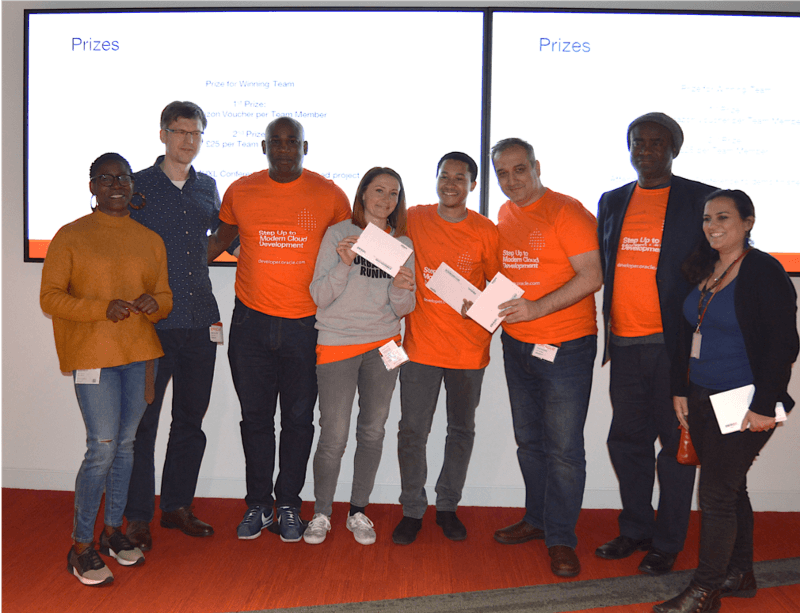

Presenting Project

Projects were judged on:

Originality

Presentation

Innovativeness

Design

Team collaboration

Prototype

Our team was the last (but not least) to present out of 7 others.

After the presentation, we had to answer a number of questions about our chatbot to the panel, including our vision for the future of this product and how users would discover Penny.

Outcome

Yes.!!!

We have been awarded as a winner of this great Hackathon.

Moving forward

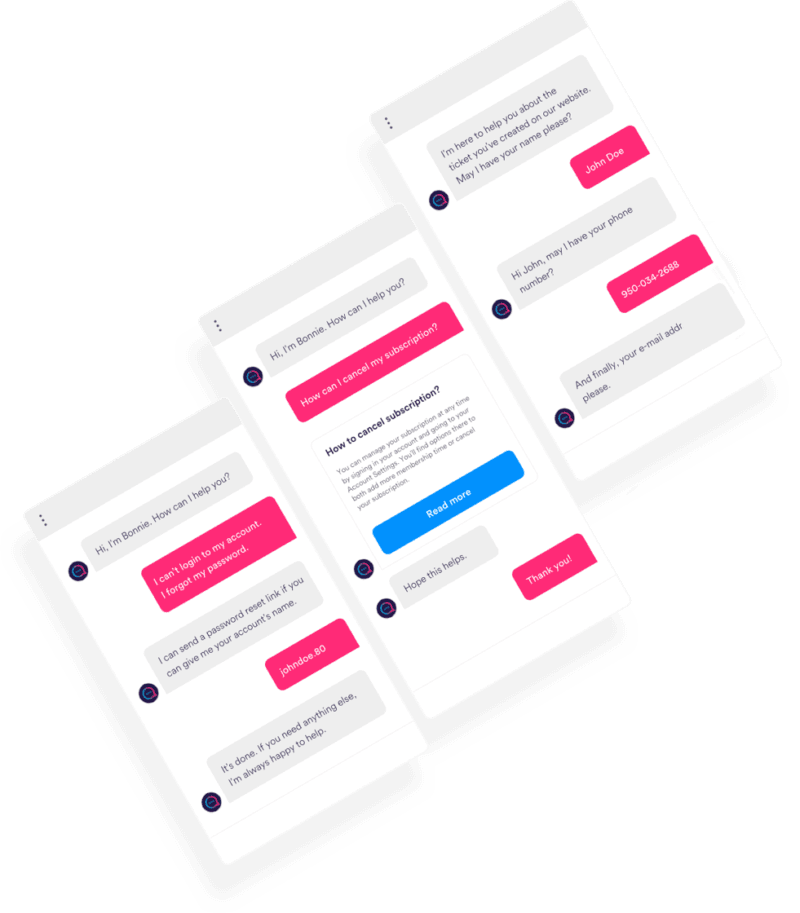

For the future, I started to develop a Next-Generation Financial Assistant Chatbot that has features like;

Intent Detection

I match user inputs to AI responses with seamless precision, utilising proprietary machine learning and Natural Language Processing abilities.Rich Messages

Various responses enable interactive, colourful and striking dialogues with buttons, galleries, images and videos.Background Analytics

For a better understanding of customers' insights, improve intelligence and total experience.Training Features

By creating an additional channel, users will have a chance to reach training materials in the conversational training environment